Silicon Statesmanship #1: Facing Reality

A ground floor view on the tech, strategy, and geopolitics of semi manufacturing

The problem is relatively simple: semiconductors, arguably the foundation of the US economy and military strength, are not in our control. US-based semiconductor production capacity has collapsed in the last 30 years, dropping from 40% of global semiconductor fabrication in 1990 to 11% in 2019.

To be crystal clear, the process of feeding our hungry computers with chips involves really 2 broad processes:

Creating the chips (designing them)

Manufacturing them

The first job takes lots of smart electrical engineers and knowledge about that particular application space; the second job is what this blog series is about.

At this point, many bits have been spilled about global semiconductor manufacturing, the CHIPs Act, and the risks of centralized production in Taiwan. What I hope to add to the noise is a unique perspective: someone who had a small role in Intel’s attempt to build a foundry. Of course, I am not going to be getting into anything confidential—it’s for someone else to write the history of ICF. Rather, I am drawing on that experience to provide a framework for non-experts to understand the dynamics and incentives for semiconductor manufacturers going forward. I started this series in late 2022 i.e. before NVIDIA blew up, to convince investors to care about semis and specifically semi manufacturing. That’s…less of a problem sitting here in 2024, with $NVDA at roughly 4x from where I started privately publishing this.

What I hope to add to the noise is a unique perspective: someone who had a small role in Intel’s attempt to build a foundry.

Now, I want to update and add to this series with some public posts. Over the course of the series, my goals are:

To educate investors, technologists, and citizens why you should care about semis and manufacturing specifically

How the manufacturing side of the business actually works

Frameworks for assessing the different options presented by governments and industry

Why there is still a big opportunity for a US-based pure-play foundry

I find the more I write, the more I have to say. I will do my best to break this up. I expect to provide updates over time analyzing how the CHIPs Act is progressing towards its goals.

Your Humble Author

To add a little detail to my perspective, I was on the go-to-market team for Intel Custom Foundry from 2015 through early 2017. During this time, Intel established a foundry, though it was extremely nascent, interesting to investors, and not a significant revenue driver. If you knocked on Intel’s door during this time and wanted to buy some Moore’s Law, you would be talking to my bosses. I cannot emphasize enough how junior I was on that team, but I got to learn a ton of how it actually works. Because Intel was not really in the business of selling their manufacturing capabilities, I was part of the team that turned tools into products, developing the messaging and positioning for Intel’s core technologies and preparing the business development team for conversations with customers. I had the least experience in foundry, which was useful in that I was willing to ask basic questions and learn things from first principles.

I am most definitely not a dark wizard of semiconductors. Dark wizards know every layer of the stack, the physics, the chemistry, the roadmap, and every inch of the manufacturing plants. They don’t just talk to the rocks, the rocks answer them. Many of you might know dark wizards—I do and learned everything here from them. One was gracious enough to read this through for me, though if a dark wizard were to correct anything here, they are almost certainly correct.

If you are unfamiliar with semis, what follows is a crash course in the situation, the players, their objectives and incentives, and their challenges. If you are already familiar with semis, treat this as a refresher on how we got to this moment.

Basic Terminology

Let’s start with some terms. Manufacturing chips is all about making transistors. A transistor is just a kind of simple electrical device with two possible states, 0 or 1. Semiconductors are a group of materials on the periodic table, which includes silicon. Semiconductors as a material were found to be an exceptional way to make transistors—there are no moving parts, the power needed is really low, and it is cheap to make many of them because you are making them by etching away what you don’t need with a chisel of light. The process of etching with light is known as lithography. Putting it together, we use light (lithography) on semiconductors (almost always silicon) to form boatloads of transistors with the collective goal of processing data faster, better, cheaper.

Put all those transistors together and conceptually, you have a circuit. When you put many circuits together, you get a die. If your dies are small enough, you can fit a lot of them on a wafer. Wafers are cut into individual die that are packaged into chips.

A wafer is a big round disc of silicon that you’ve etched a bunch of transistors into. When a manufacturer is “fabricating semiconductors”, it typically means they are producing wafers that their customer will have sent somewhere else to be cut into chips and put into devices. Plants that pump out wafers are known as fabs (short for fabrication facility). This taxonomy is so fundamental, that I’m going to reiterate the Russian nesting doll allegory to more clearly illustrate the picture. Think of the ecosystem extant on a semiconductor. Going from largest to smallest, we have: fab → wafer → chip → circuit → transistor → electron. These are all made out of a semiconductor material, silicon, that’s been doped up more than an Alameda Research analyst.

More transistors = more raw computing power. If you can fit more transistors onto a wafer (or a chip), it gives you a lot of computational, business and other options. For example, you can increase the performance of your chip, by shipping more transistors, keeping the price the same. Or you can keep performance the same and fit more chips on a wafer, lowering your overall costs. Lower costs can empower you to lower prices and take more market share or keep the margin for yourself, depending on if your competitors can do the same thing or not. The value equation of performance to cost is why there is such an economic incentive to be able to draw transistors smaller and smaller. It’s also why all the naming schemes for new technology use smaller numbers the newer the technology, because the size of the transistors you draw are smaller.

That new, smaller number often represents an entirely new manufacturing process, what the industry calls a node. Any given manufacturer might have similar but not exactly the same way of producing transistors at that size, so node comparisons often focus on transistor performance and size rather than the specifics of the tools used in the manufacturing technology.

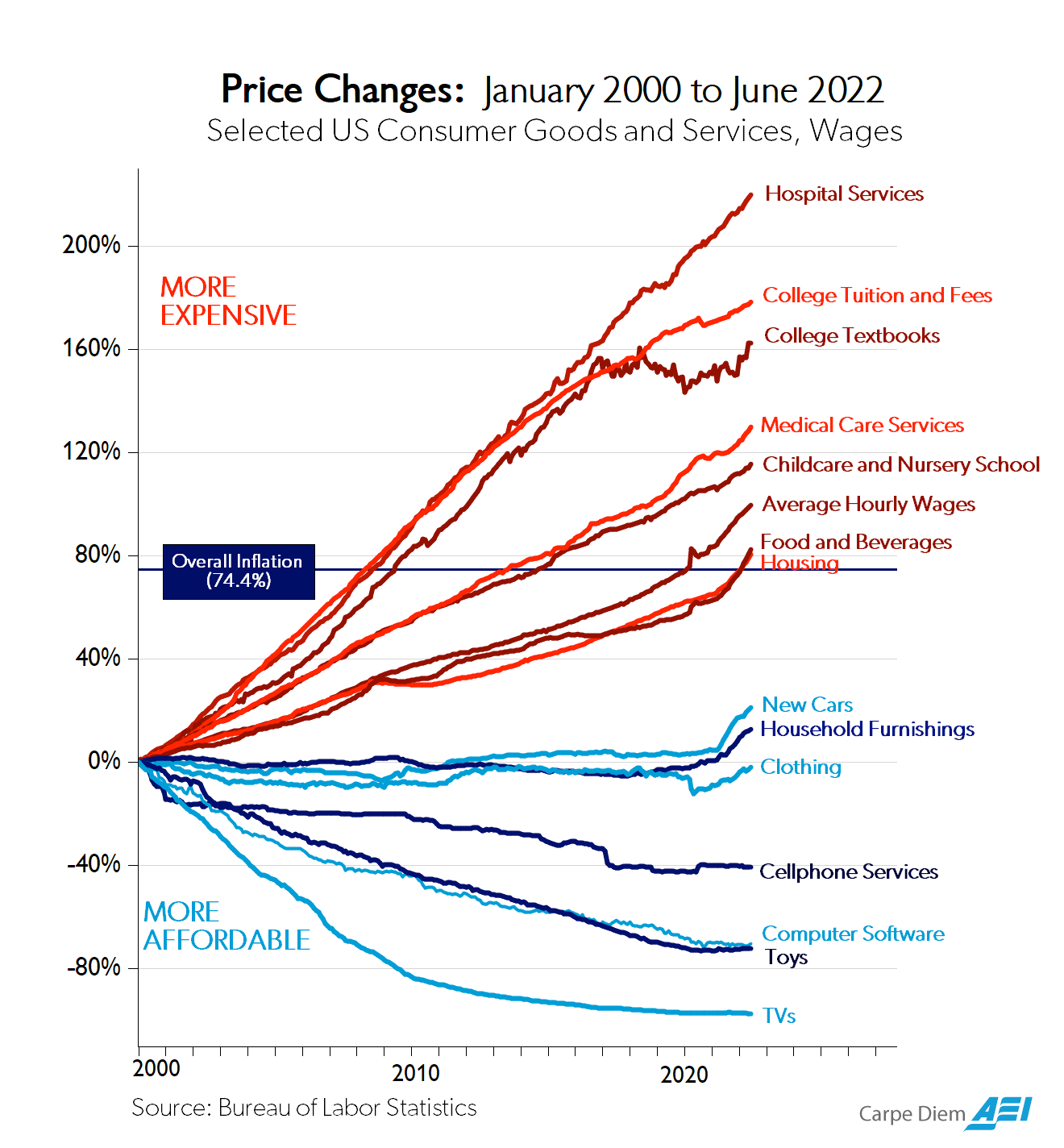

Moore’s Law outlines the process of introducing new ways of drawing smaller transistors i.e. making new nodes. In the late 60s, Gordon Moore predicted that the processing power of a given chip would double about every 18 months… and for a half century, generally speaking and miraculously, it has. The result are badass charts like this, where things Moore’s Law touches get cheaper (and, in our lived experience, much better and faster) and things that the US government touches get more expensive:

That newest node is known as the leading edge. Because the industry works so hard to keep making smaller transistors, the leading edge is a moving target. In 2024, it stands that you can roughly double transistor count every 24-48 months, which has slowed from its heyday in the 1990s of doubling transistor count every 18-24 months. If you want even more context about semiconductors, check out Steve Blank’s primer.

The Collision Course of Semiconductors and Geopolitics

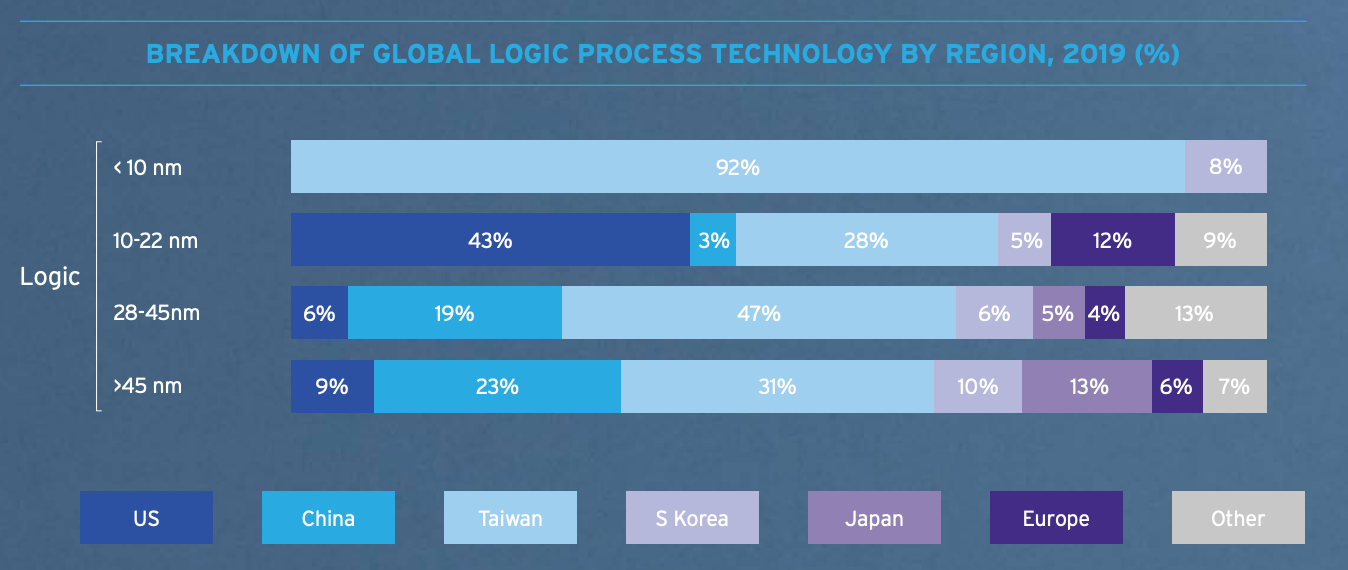

The key area in which we have “failed” lately has revolved around making the smallest possible transistors, at scale. This collapse is most notable where Intel fell behind the Moore 2.0 curve. Through 2022, Intel was as much as 2-3 years behind TSMC without much hope to catch up. In this chart, published in 2022, notice how Intel is still at 10 nm, while Taiwan (TSMC) is at <10 nm. This chart is what the US semi industry used to lobby Congress to give them money, as it legitimately set off alarms. Congress was also getting yelled at by their constituents to do something about the chip shortage, but there was not much they could do because so little production was in the US.

Specifically, this chart means that Intel is building bigger (which is by our definition NOT better) chips at 10 nanometers… and TSMC is building at scale meaningfully smaller chips - think: 3-5 nm…ish. Note that Intel and TSMC use slightly different numbering schemes because the numbers are mostly a representation of how small transistors are now for marketing purposes vs. being literally the size of a feature on a transistor. With respect to transistor feature sizes and performance, TSMC 7 and Intel 10 are regarded as about equivalent. Since its publication, Intel actually re-branded their 10 to 7 to try to eliminate this confusion, but it makes historical discussions like these a mess.

As of 2021, Taiwan Semiconductor Manufacturing Company (TSMC) produced 92% of the most advanced logic silicon in the world, in addition to a substantial portion of older but still important technology. Since the chart was published, the world is a little different. Intel managed to stop their decline, finally shipping Intel 7 née 10, as well as Intel 4 née 7 and Intel 3, a slightly improved version of Intel 4. In 2024, Intel expects to ship 20A, another new naming convention. The A in 20A stands for Angstrom, 1/10 of a nanometer. Intel will be shipping 20A or “2 nm” which is, for marketing purposes, comparable to TSMC’s 2 nm they are now shipping. You can imagine the pissing match between CEOs to claim if they’re really comparable. Samsung, the primary manufacturer in South Korea, has continued to push ahead albeit behind the more aggressive TSMC and Intel, with their 2 nm product expected to launch in 2025.

All of that is just about the leading edge, where process technology moves quickly and new plants now routinely cost $40B. Few companies can afford to invest this amount, which led to consolidation of manufacturers of leading-edge technology. However, the older processes making larger transistors matter too, as evidenced by the numerous chip shortages in automotive companies. They only use older processes. The older processes are affordable and useful when you don’t need cutting edge performance or cost.

I likely don’t have to tell anyone in the finance and investing community that China isn’t big on democracy right now, if you did any business with Hong Kong. The Chinese Communist Party has similar feelings about Taiwan, where I just highlighted is home to the vast majority of our semiconductor production capacity. Chris Miller’s Chip War is the definitive history and examination of the technological and geopolitical forces that shaped the modern semiconductor industry and the inherent risks of centralized production in Taiwan. Taiwan and TSMC now plan openly about what will happen to their production sites in the event of a Chinese invasion. Americans can confidently assume that, if Taiwan was invaded, it would take 3-5 years for us to replace that semiconductor supply, likely longer in a war-torn world. The shortage of semiconductors would ripple through our economy and come at a time when our military would need chips the most.

For Taiwan, semiconductors are a shield. Taiwan’s success is attributable to directly subsidizing semiconductors, highlighting a broader trend. The capital (both financial and intellectual) is so dear/ high/ at scale… that the business war here is no longer fought by a single company; it is fought by nations. Japan, South Korea, and a host of other key players have stepped forward to own their destiny with chip manufacturing industry.

TSMC and Taiwan’s industrial policy have out-executed everyone in capturing this space. The nation of Taiwan does not play fair: It intentionally shifts every rule it can shift so as to favor its own nation’s semiconductor manufacturing prowess, including direct subsidies of land, facilities construction, and R&D. We can’t blame them - we do the same thing and in the 100 Meter ScrewYou Proprietary Race, Apple is in the lane between TSMC and Microsoft every Olympics.

Of course, the US has jumped into this race with the CHIPs and Science Act passed in 2022. The federal government pretty much had to because American manufacturing companies simply failed to anticipate or adapt. The cost and uncertainty of building anything in the US didn’t do us any favors either.

As mentioned before, Intel should have owned this domain but failed nearly fatally, as GlobalFoundries, IBM, and Texas Instruments all essentially quit trying to continue investing significantly because it was too hard, too expensive, and there were other profitable ways to build products on older processes. That groups’ operations remain but they have ceded the most powerful part of the market. There was no other American competition - Intel should have run the tables. But they didn’t because they missed making chips for smartphones. When Intel encountered the new smartphone paradigm, they prioritized protecting their software ecosystem known as x86 instead of embracing the size of this new market. (x86 is another new term that references the instruction set architecture which is roughly how software programs talk to the chips.) The software ecosystem ensures only their chips can be sold into those applications, which is great for fat margins and big competitive barriers (see: NVIDIA with CUDA). Their failure to anticipate or address mobile opened the floodgates for Apple, ARM, and TSMC to build a new ecosystem bigger and better than Intel’s.

Intel’s mistakes were not necessarily a bad thing for the US. Intel would primarily design and manufacture its own products, a business model known as integrated device manufacturer or IDM, such that they competed with nearly everyone. TSMC however only manufactures semiconductors, a model known as foundry—they will offer their capacity to (nearly) anyone and will not compete with their customers. Much more on that topic in the next episode. TSMC’s ascendancy benefited many other American companies, who now had access to silicon processes that rivaled what Intel could make. The feeding frenzy for Intel’s market share was on.

TSMC’s ascendancy benefited many other American companies, who now had access to silicon processes that rivaled what Intel could make.

Intel has been grappling with this mistake for over a decade. Before Pat Gelsinger, the board attempted to protect Intel’s profit margins while its scale and market share declined. This spiral is suicidal in the semiconductor industry. The natural conclusion of this path would be to break up Intel, similar to AMD’s fate. The manufacturing assets would become a pure-play foundry while the design side would be a fabless chip designer that can work with any foundry. By hiring Pat Gelsinger, the board decided to try to avert this path. Gelsinger has made it clear he wants to keep Intel together at a scale that would set Intel to be a leader. Notably, he has Intel executing extremely well, but they are still only challenging for the crown while core parts of their business face strong headwinds. Critically, Intel has done all of this without CHIPs Act money—leadership matters.

One popular option for bringing the leading edge back to America is using American political leverage to have TSMC build more plants here to satisfy US demand, to ensure continuity in US supply. TSMC’s recent investments in the US are a reflection of that. While they are a political concession to Apple and the Biden administration, I believe they will be net good for the US. The new plants will create more jobs for technicians, spur suppliers to invest more deeply in our supply chains, and place in the US more of the critical next-gen tools required to build the best performing chips. However, these investments aren't going to significantly shift production from Taiwan. Said another way, TSMC does not want serious competition and it will desperately go out of its way to stem the tide of “fair play” competition. Duh. Welcome to America. Our best companies do the same thing. At least Japan has succeeded in getting them to diversify more in their country than fully centralizing operations in Taiwan.

However, these investments aren't going to significantly shift production from Taiwan.

Presently, these various strategies are on a collision course. If we are to change our destiny as projectiles of TSMC, we need to change our tune, or at least have one as it relates to mass scale manufacturing of cheap chips. The CHIPs Act is a nice start. The gist is that we need a real, leading-edge foundry here in the US. Intel believes it can be that foundry, but their business model asks customers to trust a powerful competitor with the core of their business in an industry where only the paranoid survive.

The price tag for a leading edge fab starts at roughly $40B. Think about the $40B+ price tag: it is 1/3 of the price California wants to pay for high-speed rail. Think of how small this number is in the scheme of all the things we spend money on… and how important it remains for us to control the fate of our own semiconductors.