A Thorough Inspection

Making a leading-edge wafer today requires several hundred to over a thousand distinct process steps, each representing a chance to introduce a defect. Any given defect can limit or eliminate the potential value of the end-use chips. Semiconductor manufacturing processes with too many defects are a potential company killer. Catching defects as early as possible and quickly fixing them is critical to a smooth rollout, and it relies on frequent inspection (and increasingly, virtual simulations). American citizens should apply similar principles to semiconductor industrial policy, as companies receive billions of taxpayer dollars.

The government has allocated roughly $39B for semiconductor investment in the US—are they spending it wisely? The next several posts are all about frameworks for analyzing the implementation of the CHIPs Act. Annie Duke’s Thinking In Bets introduced me to the idea of resulting: judging the wisdom of a bet purely by its outcome. In games of allocation and skill, she urges readers against resulting. Instead, bettors should consider the quality of decision-making that went into the bet versus solely judging if the bet worked or not. As the CHIPs Act Program Office awards grants, this series will evaluate the quality of decision-making going into their choices. What were the problems in the US semi-manufacturing market such that we are so dependent on other countries? What problems did the government select to address? How well does the application of funds achieve their desired ends? Are the funds going towards permanent or temporary solutions? Today, we will start with a thorough inspection of the state of US semi-manufacturing at the time of the bill becoming a law, circa 2022.

The TL;DR stated strategy of the CHIPs Act:

Large scale investments in leading edge manufacturing

New manufacturing capacity for mature and current-generation chips, new and specialty technologies, and for semiconductor industry suppliers

Initiatives to strengthen U.S. leadership in R&D [Rob’s Note: this is important but a relatively small amount and outside purview of this series]

What You Will Learn

How escalating fab costs drove industry consolidation

How US perception of competition with China is changing the definition of leading-edge

How depreciated fabs made it affordable to put connected chips in everything

How the business model for older chips is brokens

In Facing Reality, we covered the core problems facing the US: the production of semiconductors, arguably the foundation of our economy and the heart of protecting our national security, is not within our control. We outsourced manufacturing and exist at the whim of foreign governments who may or may not play nice with us.

The second part, Technoeconomic Pillars of Foundry, is a crash course in the business of foundry and the necessary concepts to understand what makes the industry tick. In short, to survive economically a foundry needs 5 things:

Scale

High yield

Continuing technology development

A comprehensive ecosystem of IP and downstream partners

Customer trust

Throughout, I have cited how easy it is for contract manufacturing of semiconductors to go wrong if a company gets any of these 5 wrong, which brings us to our first topic.

Cultivating Mass at the Leading Edge

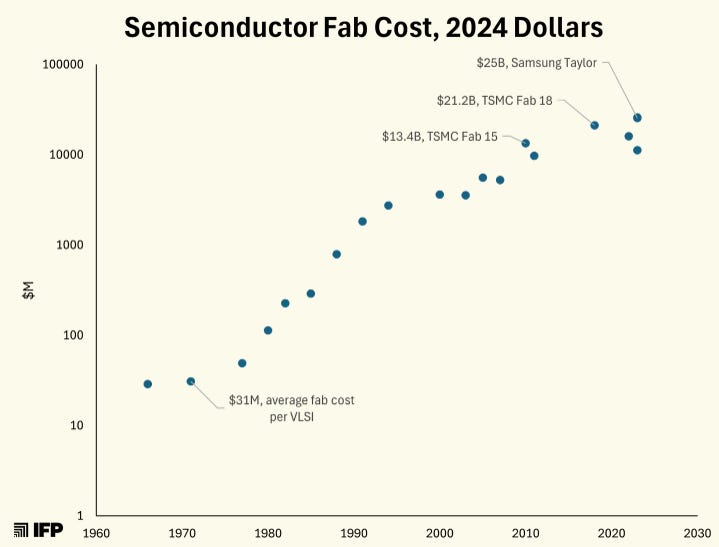

In semiconductor production, scale matters because it enables both return on investment and the funds to invest in the next smallest process technology. Historically, most of the profits were derived from the newest technology because older technology got commoditized quickly. Big margins in iPhone 14 chips; way smaller margins on iPhone 11. That would be fine if the costs to build a fab were about the same from generation to generation. Instead, semiconductor fab costs have gone up exponentially (note the y-axis below is logarithmic). Without profits to drive R&D and CapEx, manufacturers have a nice fab but are out of the technology race’s cutting-edge, high-margin “sexy” chip business.

Oh, it gets worse. It takes $25B just to play the game, and now you have to fill it with orders. The demand for those orders goes through pretty wild swings (the dot-com bust, the Great Recession, Covid, good and bad economic cycles…), from annual drawdowns of 40% to upswings of 50%. For an industry that is gambling to breakeven over the span of years, a big downswing in demand can wipe out a foundry. (This fact is particularly poignant when the fab does not have a nation’s capital backing it. Hi, TSMC and Taiwan.)

The scale required to invest in new fabs and the demand risk meant only a dwindling number of players could stay in the game: Intel, Samsung, and TSMC. GlobalFoundries dropped out a decade ago at 16 nm, and by 2021 Intel was at least a full node (~2-3 years) behind TSMC. There was a very good chance Intel was going to lose the scale required to compete with TSMC. No company that has dropped out has ever gotten back in.

Yet, the chart is outdated; and one development since its publication in 2021 was a major impetus for the CHIPs Act. Note that the chart above was published in 2021, and a company called SMIC had reached 14 nm. SMIC stands for Semiconductor Manufacturing International Corporation, a dry Western name for China’s most advanced semiconductor foundry. With the backing of the PRC’s generous funds, deep desire for self-reliance, and every tool they would need, SMIC has since advanced from 14 nm to 7 nm and 5 nm despite being a Listed Entity by the Department of Commerce. These advancements only seemed to surprise journalists—the industry knew they could use the tools to make smaller transistors, if they’re willing to do so at higher costs (allegedly up to 50% higher than TSMC though respected and informed analyst Dylan Patel believes it is much higher). Moving beyond that may not be possible for SMIC — the technique used to get from 14 nm to 5 nm has a limit to its usefulness and technology restrictions prevent them from obtaining the EUV tools that would enable them to progress.

That 5 nm threshold is what the Department of Commerce is focused on. There are two ways to interpret the mandate for the CHIPs Act:

Ensure the US has a domestic supply of the most advanced logic manufacturing

Ensure the US has a domestic supply of logic manufacturing more advanced than China

The CHIPs Act dedicates “approximately three quarters of the incentives funding, around $28 billion, to establish domestic production of leading-edge logic and memory chips that require the most sophisticated manufacturing processes available today”. When a fab already costs $20-25B and growing exponentially, picking which problem to solve is critical:

Is the US shifting something structural, to ensure leading-edge always happens on US soil?

Is the US “renting” leading-edge in the sense that they were the highest bidder this time and may not be in the future?

Is having more fabs with better technology than China more important than fewer fabs with the best technology?

How will inducing supply affect its relationship with demand? How much risk is there of underutilization, accounting for the subsidy reducing costs?

Lagging Edge Proliferation

Again, the profits and scale mostly chase the smallest transistors. High-performance computing (chips for PCs, servers, and smartphones) are the groupies of Moore’s Law, chasing the latest and greatest technology. But as technology progresses, the older fabs still work, and their value proposition gets intensely interesting when they are fully depreciated.

The tooling inside the fab is the most expensive part. When those tools are fully depreciated, it is effectively only the cost of sand, electricity, labor, and maintenance to continue production. Part of Morris Chang’s brilliance was continuing to keep TSMC’s fabs running forever, finding new applications for them, at a time when the rest of the industry would salvage any useful tools for newer production and sell the rest. The older stuff is in demand by market segments like Automotive and what is now called Internet of Things (IoT). The main advantages of older technology is 1) the tools to design and manufacture the chips are battle-tested and 2) it’s very cheap because the fabs are almost fully depreciated. The chips are great fits for applications that prioritize cost and certainty of the chip’s functions. These attributes are why chips got embedded everywhere, now with the connectivity that we refer to as the Internet of Things. The importance of all of these segments has only grown with time. In 2023, IDC estimated IoT spend at $800B globally. In 2024, IDC estimated the automotive semiconductor market at $40B in 2020, growing quickly to $88B by 2027.

The design and marketing of these chips was predominantly done by US, European, and Japanese companies, and very few of these products are manufactured in the US. China is making massive investments here with their most recent fund topping $45B. The PRC’s objectives are to, first, secure the supply chain for their nascent and surging EV industry and, second, win every other market globally. Instead of asking Chinese companies to shoulder the capital risk, China has used government subsidy to consistently grow its share of semiconductor manufacturing capacity, largely through adding capacity to older process technologies:

A Broken Business Model

What few industry players expected, however, was that demand for older technologies kept growing. Doug O’Laughlin at Fabricated Knowledge lays this out in detail, including the points about depreciation made above, so I will do my best to summarize the new parts:

Around 2014, the newest fabs started using different tools (larger wafers, different materials). This “broke” backwards compatibility, in the sense that now you could not repurpose these tools to do the older jobs. They could continue to do the primary job they were deployed for, and those would get cheaper with time, but foundries lost the built-in flexibility to use them for alternate lines.

In 2020, demand for cars dropped quickly before surging, whiplashing the demand for the chips that make those cars run.

The older fabs were essentially full, creating a demand shock.

The foundries could not react quickly with more supply. In the short term, they could not repurpose other lines—they were structurally too different. In the longer term, adding more capacity would mean building new facilities and buying new tools. Recall the economics of a new fab with brand-new equipment are dramatically different from a fully depreciated one.

Therefore, to invest with confidence in new facilities building ancient tech, the foundries secured long-term agreements and non-cancelable, non-returnable orders from their customers.

Essentially, the business model broke during the pandemic. Like our country’s national debt, worrying about running out of depreciated fabs was a future problem i.e. somebody else’s problem, until we ran head-first into that problem. Meanwhile, American companies downstream increasingly rely on these chips; without them lines shut down. In 2022, American companies had to choose to either deal with shortages when demand is high or put capital at risk for foundries to expand capacity that still wouldn’t be online for years.

Turning back to the CHIPs Act:

How much subsidy is required to get new domestic supply?

Will American chip manufacturers of mature nodes receiving funds compete effectively in the global market? Or will they mostly exist to satisfy demand requiring US suppliers e.g. defense?

Will the application of government funds fix the structural issues with lagging-edge supply? Or will additional capacity require more subsidy?

How to Grade the CHIPs Act

To summarize, here is my scorecard of the problems the Department of Commerce could choose to address:

Leading Edge Problems

Will the application of funds create the most advanced fab in the world?

Will the application of funds make the United States the most desirable place in the world to build future leading-edge fabs?

Given the goal of building more capacity at a level beyond what China is believed to be capable of, how much capacity will be generated with the application of funds?

How will inducing supply affect its relationship with demand? How much risk is there of underutilization, accounting for the subsidy reducing costs?

Lagging Edge Problems

How much will the application of funds encourage domestic semiconductor production of mature nodes?

Will American semiconductor manufacturers be able to compete effectively in the global market for relatively commoditized silicon?

Will the application of funds fix the structural issues with lagging edge supply in a sustainable way?

Fortunately, the US government has not been completely asleep on these issues. As I will demonstrate, most of the stuff in the headlines is focused on solving Problem #1, while Problem #2 is…uh…brace for impact. In our next post, we will cover the primary options available to the CHIPs Act through the lens of how well each would address these questions (and raise some new ones) and give some preliminary grades.